Making The Most Of Health Care Coverage With Medicare Advantage Insurance Coverage

As the landscape of healthcare continues to evolve, individuals seeking comprehensive insurance coverage usually turn to Medicare Advantage insurance for a much more comprehensive strategy to their medical demands. The attraction of Medicare Benefit lies in its prospective to provide a wider range of services past what conventional Medicare plans offer.

Benefits of Medicare Benefit

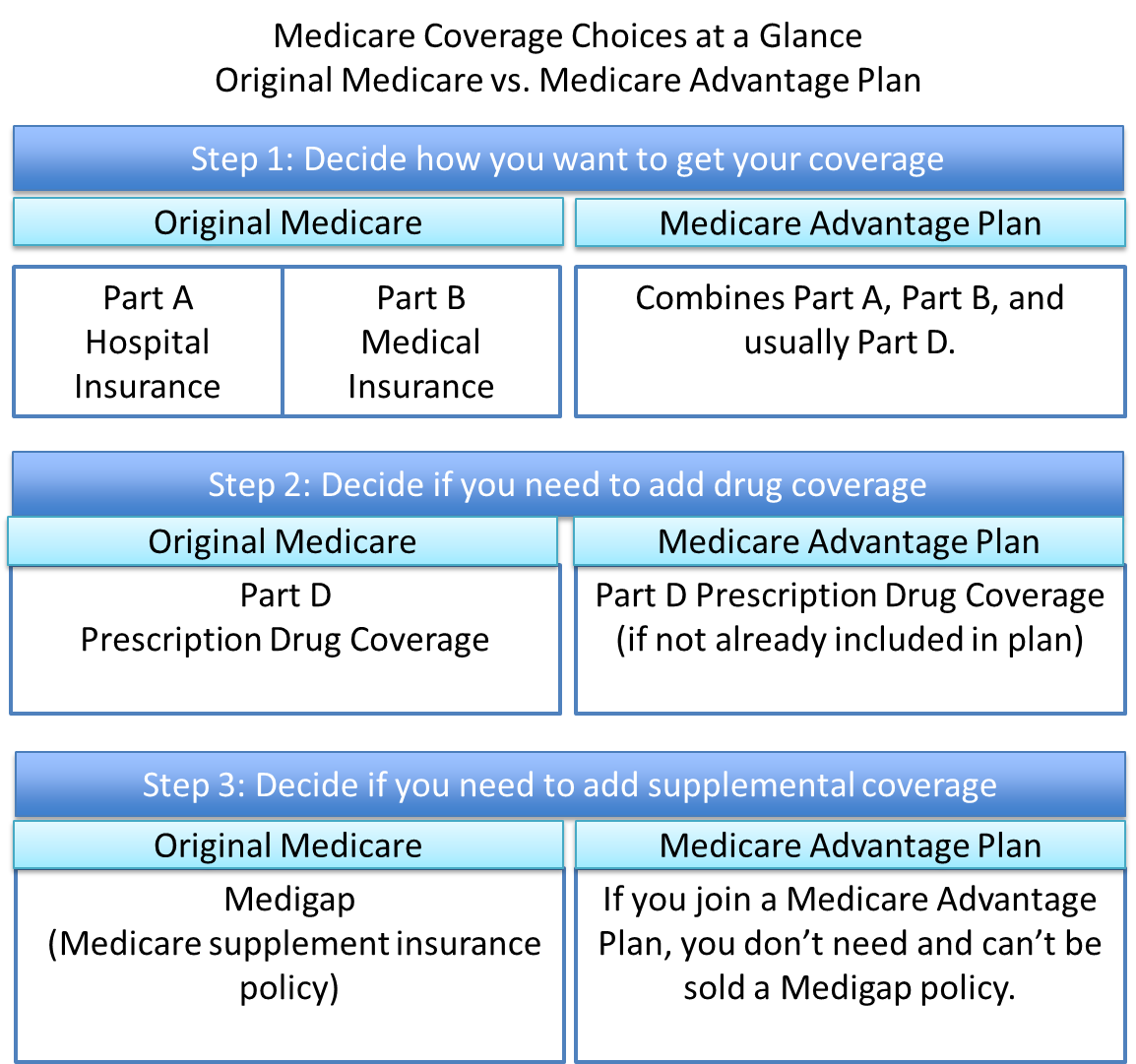

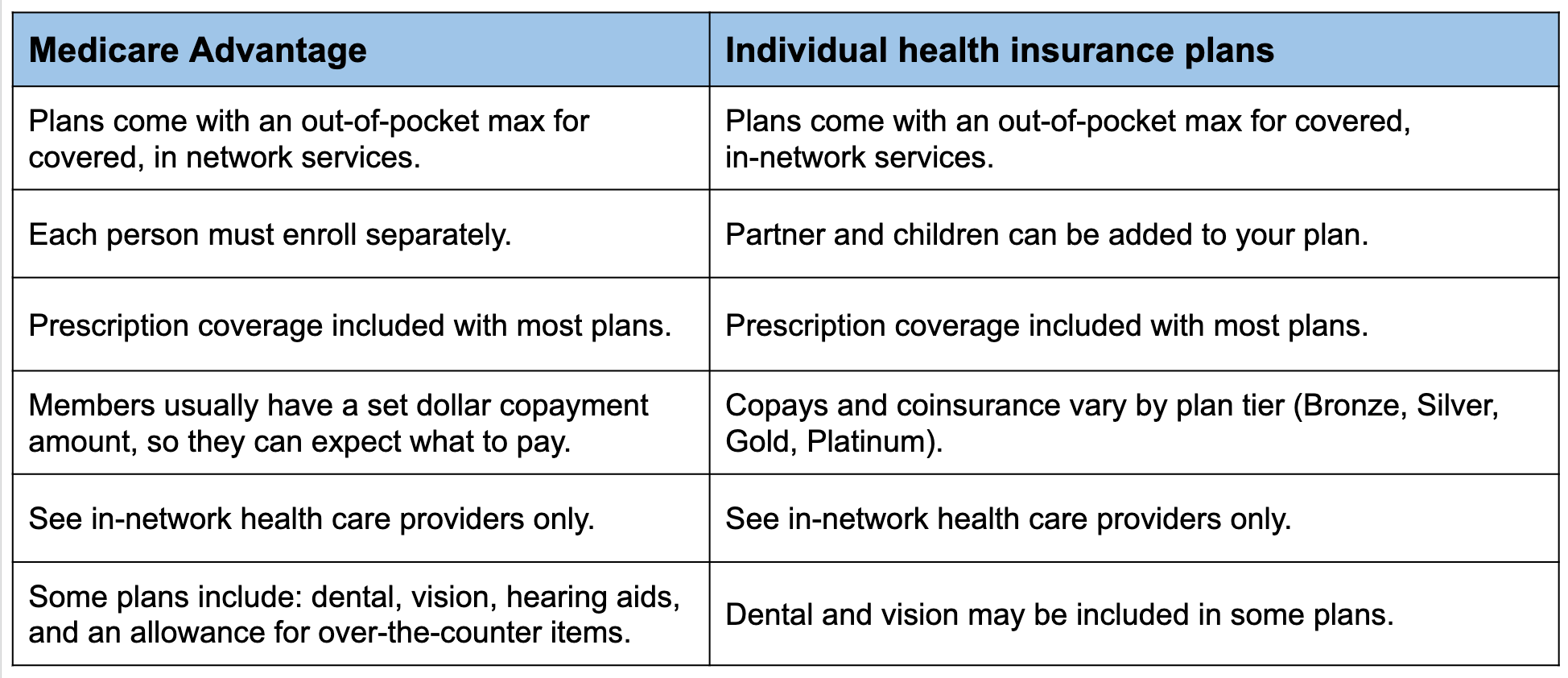

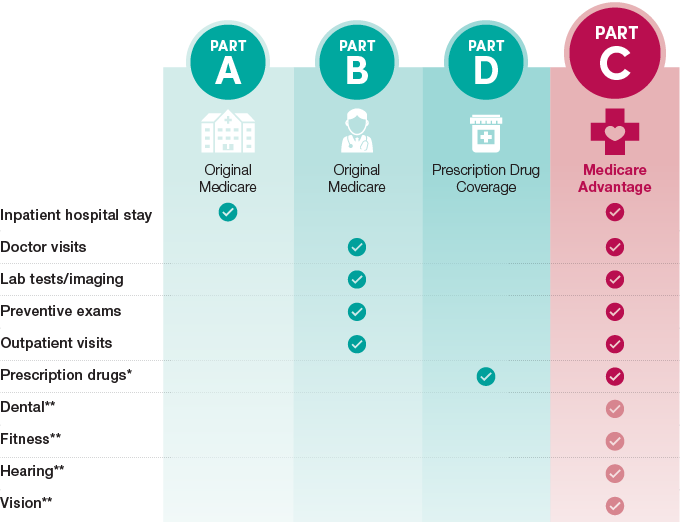

Medicare Advantage plans, likewise understood as Medicare Component C, supply several advantages that set them apart from traditional Medicare strategies. One vital advantage is that Medicare Advantage intends typically include extra coverage not offered by original Medicare, such as vision, oral, hearing, and prescription drug protection.

Furthermore, Medicare Advantage plans commonly have out-of-pocket maximums, which limit the amount of cash a recipient needs to spend on protected services in a provided year. This financial defense can give comfort and aid people allocate health care costs better (Medicare advantage plans near me). In addition, lots of Medicare Benefit intends offer health care and other preventative solutions that can aid recipients stay healthy and balanced and take care of persistent problems

Enrollment and Qualification Requirements

Medicare Advantage strategies have details enrollment needs and eligibility standards that people need to fulfill to enlist in these thorough healthcare protection alternatives. To be eligible for Medicare Advantage, people need to be enrolled in Medicare Component A and Part B, also referred to as Original Medicare. Additionally, most Medicare Advantage prepares need applicants to live within the plan's service area and not have end-stage renal illness (ESRD) at the time of registration, though there are some exemptions for people currently registered in a Special Needs Strategy (SNP) tailored for ESRD clients.

Cost-saving Opportunities

After making sure qualification and registering in a Medicare Benefit strategy, individuals can explore different cost-saving opportunities to optimize their medical care coverage. One significant method to conserve costs with Medicare Advantage is through the strategy's out-of-pocket optimum restriction. As soon as this limitation is reached, the plan commonly covers all extra approved medical expenditures for the remainder of the year, giving monetary relief to the recipient.

One more cost-saving possibility is to use in-network doctor. see this here Medicare Benefit prepares usually work out affordable prices with specific physicians, hospitals, and pharmacies. By staying within the strategy's network, people can benefit from these reduced prices, ultimately minimizing their out-of-pocket expenditures.

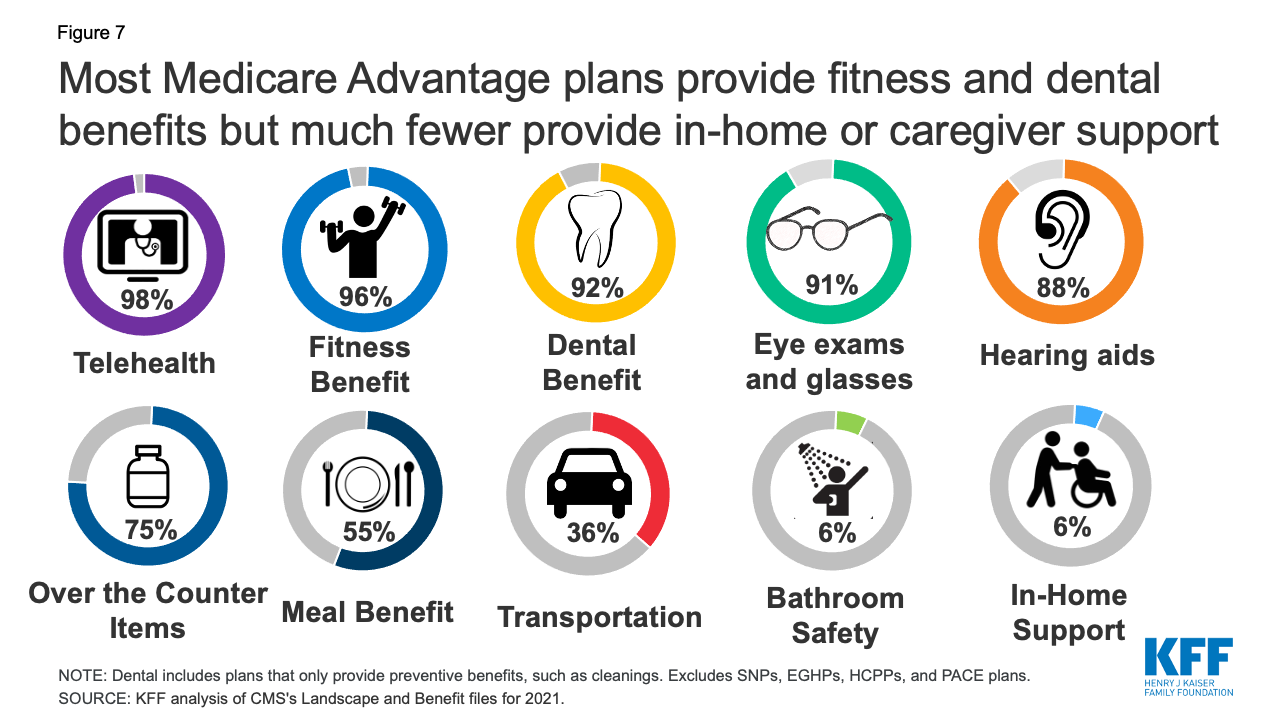

Moreover, some Medicare Advantage plans offer fringe benefits such as vision, dental, hearing, and health care, which can assist people save money on services that Original Medicare does not cover. Making the most of check this site out these extra benefits can lead to significant cost savings gradually.

Additional Protection Options

Exploring extra health care benefits beyond the fundamental insurance coverage offered by Medicare Advantage strategies can enhance overall health and wellness end results for recipients. These added protection options often include solutions such as dental, vision, hearing, and prescription medicine protection, which are not usually covered by Initial Medicare. By availing these supplemental advantages, Medicare Benefit beneficiaries can deal with a larger series of medical care requirements, leading to boosted high quality of life and far better health management.

Dental protection under Medicare Benefit plans can include routine check-ups, cleansings, and even major oral procedures like root canals or dentures. Vision benefits might cover eye tests, glasses, or get in touch with lenses, while listening to coverage can assist with listening devices and associated services. Prescription medication insurance coverage, likewise understood as Medicare Part D, is vital for managing medicine prices.

Additionally, some Medicare Benefit plans deal extra rewards such as fitness center subscriptions, telehealth solutions, transportation aid, and over-the-counter allocations. These additional advantages add to a more detailed healthcare technique, promoting precautionary care and prompt treatments to sustain recipients' wellness and health.

Tips for Maximizing Your Plan

Just how can recipients make one of the most out of their Medicare Benefit strategy insurance coverage while maximizing medical care benefits? Here are some crucial pointers to assist you enhance your plan:

Understand Your Insurance Coverage: Put in the time to assess your strategy's benefits, including what is covered, any type of limitations or constraints, and any out-of-pocket costs you may incur. Knowing your coverage can aid you make educated health care choices.

Make The Most Of Preventive Solutions: Several Medicare Benefit intends deal insurance coverage for preventive solutions like screenings, vaccinations, and wellness programs at no additional price - Medicare advantage plans near me. By keeping up to date on preventive care, you can assist maintain your wellness and potentially prevent more severe health problems

Review Your Medications: Make sure your prescription medicines are covered by your plan and discover opportunities to minimize costs, such as mail-order drug stores or common choices.

Conclusion

To conclude, Medicare Benefit insurance supplies numerous advantages, cost-saving possibilities, and additional protection choices for eligible people. Medicare advantage plans near me. By optimizing your strategy and benefiting from these benefits, you can guarantee comprehensive healthcare insurance coverage. It is crucial to meticulously review registration and qualification standards to make the many of your strategy. With the right strategy, you can maximize your health care insurance coverage and accessibility the care you need.